42 the coupon rate of a bond is equal to

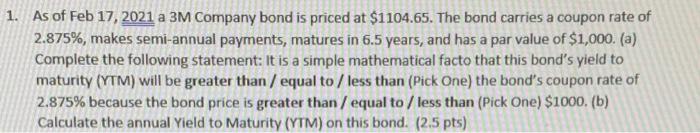

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The calculation of simple interest is equal to the principal amount multiplied by the interest rate, multiplied by the number of periods. is higher than the coupon rate of the bond, the price of the bond is likely to fall because investors would be reluctant to purchase the bond at face value now, when they could get a better rate of return elsewhere. Conversely, if prevailing interest rates fall below the coupon rate the bond is paying, then the bond increases in value (and price) because ... Bond Basics: Issue Size and Date, Maturity Value, Coupon Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. ... All else equal, its bonds would rise in price, say, to $10,500; the yield would fall, because prices and yields move in opposite directions.

FINC 301 - CH 8 Flashcards | Quizlet The value, or price, of any asset is the future value of its cash flows. If a bond's coupon rate is equal to the market rate of interest, then the bond will sell: at a price equal to its face value a bond is an ______ to the co. that purchased it (investor) asset; debt to issuer bonds are _________ securities fixed income

The coupon rate of a bond is equal to

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% If the coupon rate of a bond is equal to its required - Course Hero 22 ) If the coupon rate of a bond is equal to its required rate of return , then ________. A ) the current value is not equal to par value. B ) the current value is equal to par value. C ) the maturity value is equal to par value. D ) the current value is equal to maturity value. Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

The coupon rate of a bond is equal to. Solved Which of the following statements is incorrect? a. If | Chegg.com a. If the coupon rate of a bond s equal to the nvestor's required rate of return, the present value of the bond should be equal to the par value. O b. If the coupon rate of a bond is above the investor's required rate of return, the present value of the bond O c. If the coupon rate of a bond is below the investor's required rate of return, the present value of the bond O d. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount. While calculating the cost of debt, why isn't the coupon rate of a bond ... A bond paying a 3% coupon that you pay par (ie 100 cents on the dollar), the yield will be 3%. If you pay more than 100 cents on the dollar, your yield will be less. If you pay a high enough price, that yield will be negative. Each bond has its own coupon characteristics. Solved If the current price of a bond is equal to its face | Chegg.com If the current price of a bond is equal to its face value Select one: a. the coupon rate must be greater than the yield to maturity. b. the yield to maturity must be greater than the current yield. c. the current yield must be greater than the coupon rate. d. there is no capital gain or loss from holding the bond until maturity. Expert Answer

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market. Difference Between Coupon Rate and Discount Rate (With Table) The Coupon rate is the pace of revenue being paid off for fixed pay security like securities. This interest is paid by the bond backers, where it is being determined yearly on the bond's presumptive worth, and it is being paid to the buyers. Difference Between Coupon Rate and Yield of Maturity A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with respect to its face value denoted as a percentage. The coupon rate is like fixed income security for governments in which the issuer of the bond receives the annual interest payments. finance 6 Flashcards | Quizlet the discount rate that makes the present value of a bond's payments equal to its price is termed the: a. rate of return b. yield to maturity c. current yield d. coupon rate b. yield to maturity what is the coupon rate, for a bond with 3 years until maturity, a price of $1053.46, and a yield to maturity of 6%? a. 6% b. 8% c. 10% d. 11% b. 8%

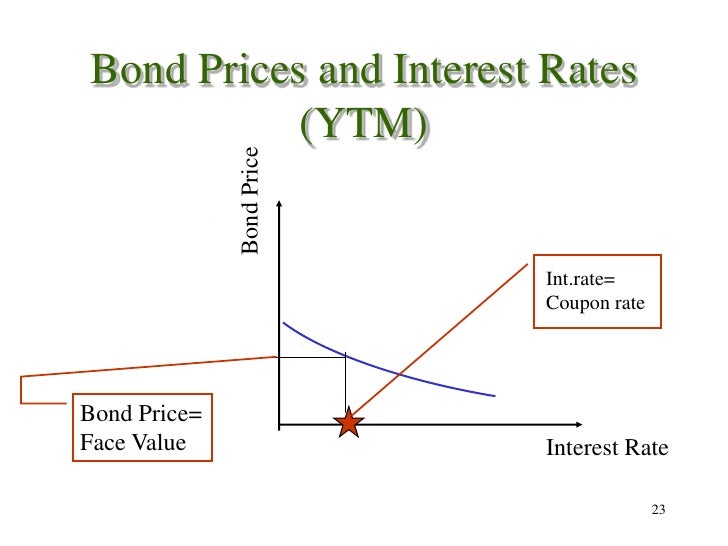

(Get Answer) - The yield to maturity (YTM) for a bond is: Group of ... The yield to maturity (YTM) for a bond is: Group of answer choices. equal to the coupon rate for bonds priced at par. the expected rate to be earned if held to maturity. All of these are correct. the rate that is used to determine the market price of the bond. the rate that equates the price of the bond with the present value of the bond's ... 2022 CFA Level I Exam: CFA Study Preparation The value of a bond is equal to the present value of its coupon payments plus the present value of the maturity value. ... the lower a security's value. Example. A 1-year, semi-annual-pay bond has a $1,000 face value and a 10% coupon. At a discount rate of 8%, the bond value is $1,019 (premium). At a discount rate of 10%, the bond value is ... Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... Par Bond - Overview, Bond Pricing Formula, Example A bond with a face value of $100 and a maturity of three years comes with a coupon rate of 5% paid annually. The current market interest rate is 5%. Using the bond pricing formula to mathematically confirm that the bond is priced at par, Shown above, with a coupon rate equal to the market interest rate, the resulting bond is priced at par.

How to Calculate the Price of Coupon Bond? - WallStreetMojo It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%.

fixed income - Bond interest rate, the relationship between a bond's interest rate and its ...

Why a bond's price is equal to the par value when coupon and yield ... Why a bond's price is equal to the par value when coupon and yield rates are same? A bond equals the par value when coupon and yield rates match each other. Briefly saying a bond must trade at par when its coupon payment is able to match the investor's expected rate of return. For a clear picture, let us understand the situation through an example.

(Get Answer) - Il else constant, a bond will sell at a premium; equal ... Il else constant, a bond will sell at a premium; equal to when the coupon rate is the yield to maturity. O par; less than O a discount; higher than O a discount; less than O a premium; less than These roads offer very little traction O One-way streets O Expressways O Gravel or dirt roads

What Is Coupon Rate and How Do You Calculate It? Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year.

Weineng successfully issued the first green new energy battery asset ... The total issuance scale was 635million yuan, with the priority A1 coupon rate of 2.97%, the priority A2 coupon rate of 3.45%, and the priority A3 coupon rate of 3.76%. This product was jointly created by China Securities Finance Co., Ltd. and Huatai Securities. ... the green bond support catalogue of the people's Bank of China, the green bond ...

If coupon rate is equal to going rate of interest then - Examveda Answer: Option A Solution (By Examveda Team) If coupon rate is equal to going rate of interest then bond will be sold at par value. A coupon payment on a bond is the annual interest payment that the bondholder receives from the bond's issue date until it matures.

Why would two coupon bonds with the same maturity have a different ... The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000 that is a 4% annual rate. If the annual coupon of a bond is $40. And the price of the bond is $1150 then the yield on the bond will be 3.5%.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Post a Comment for "42 the coupon rate of a bond is equal to"