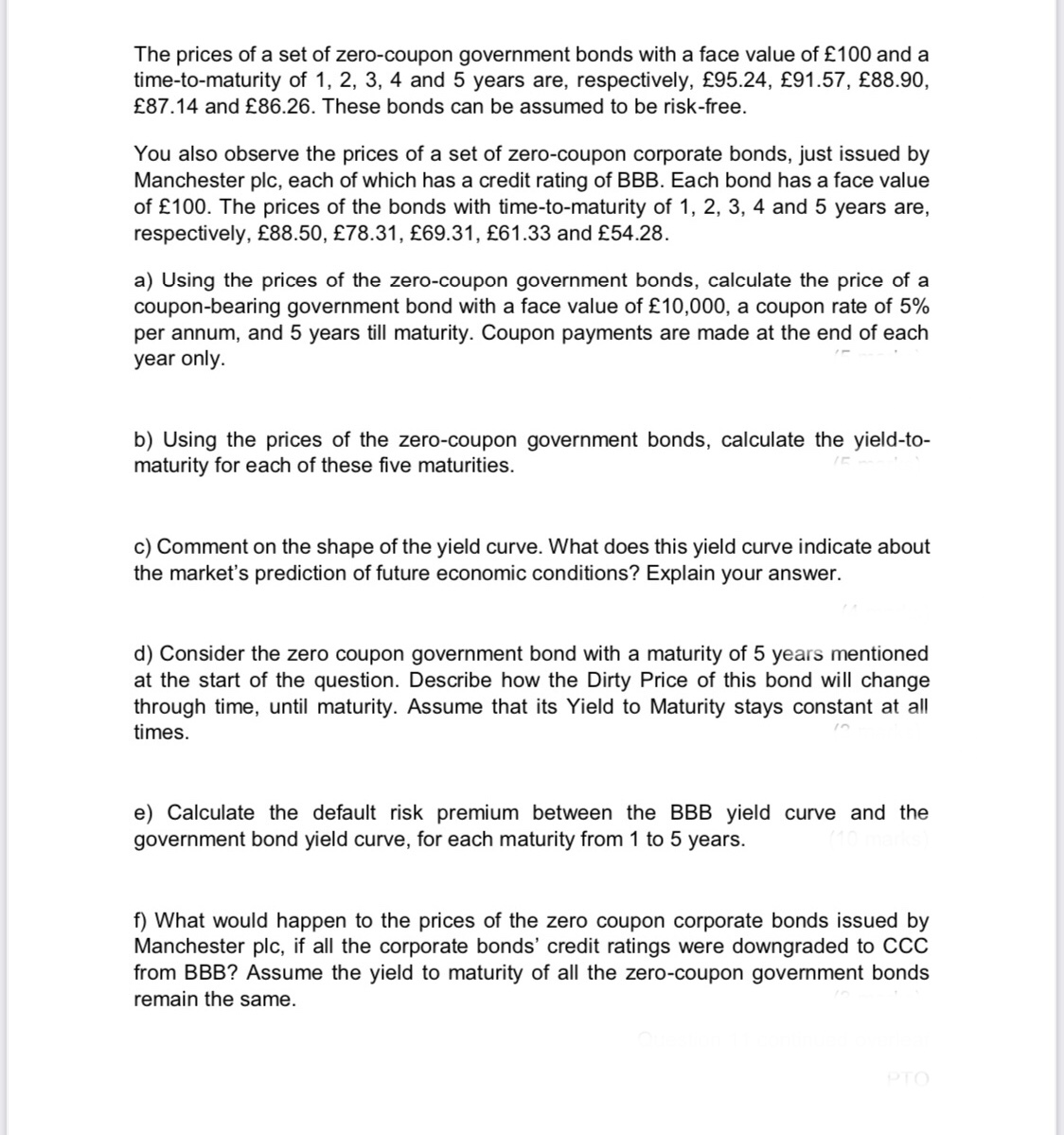

39 is yield to maturity the same as coupon rate

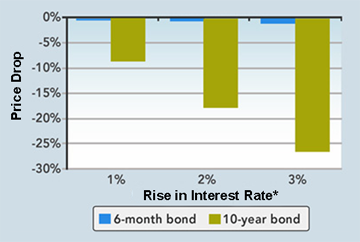

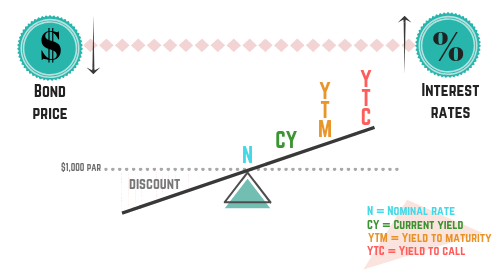

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05%, So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The interest rate of a bond is not the same as its coupon rate. Let's understand this with an example. Mr Ananth buys a bond at INR 1,000 (face value), and the coupon rate is 10%. ... A bond's price has an inverse relationship to its yield to maturity rate. As interest rates rise, there is a demand for greater returns. Therefore, the price ...

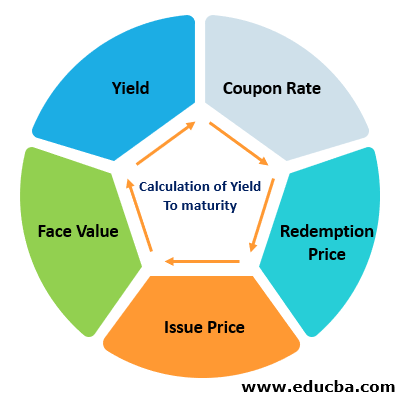

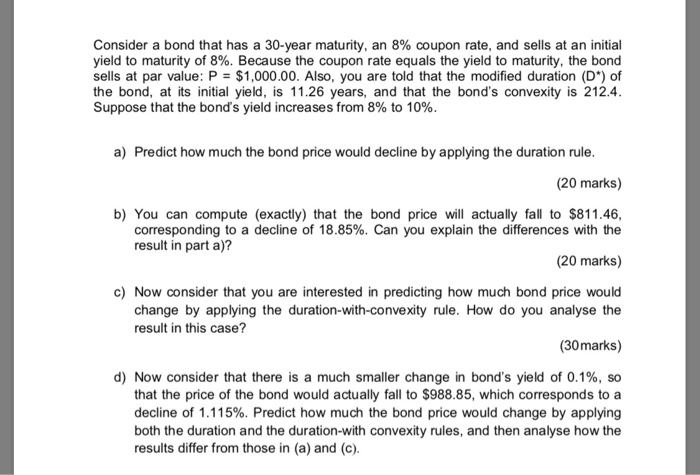

Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return (IRR ...

Is yield to maturity the same as coupon rate

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic, Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest... Why is the yield to maturity of a bond equal to the coupon rate ... - Quora Answer (1 of 3): If we're talking about straight bonds that are issued at $1000, the coupon, the current yield and YTM are identical in the instant they are issued, and probably never again. That's because current yield and YTM are a function of time and market price, which will constantly chang...

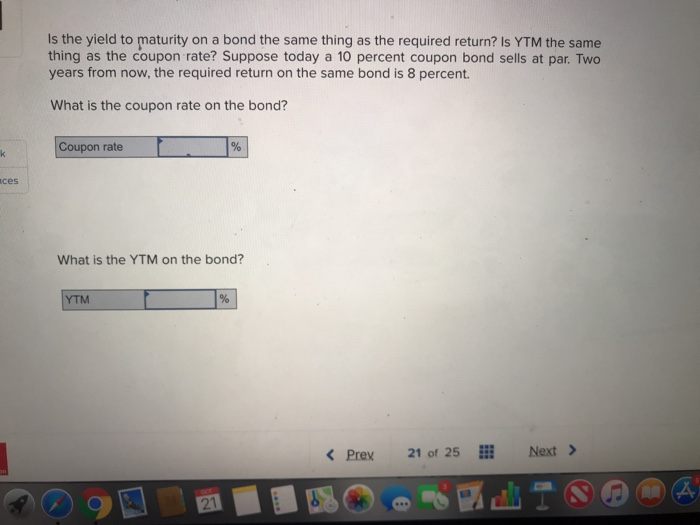

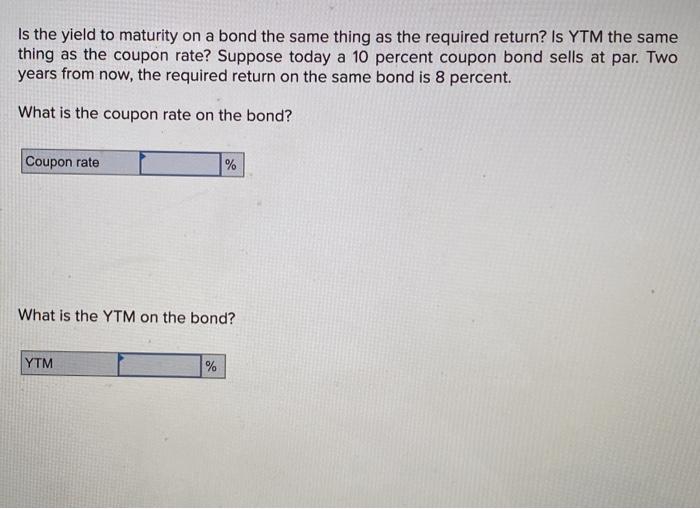

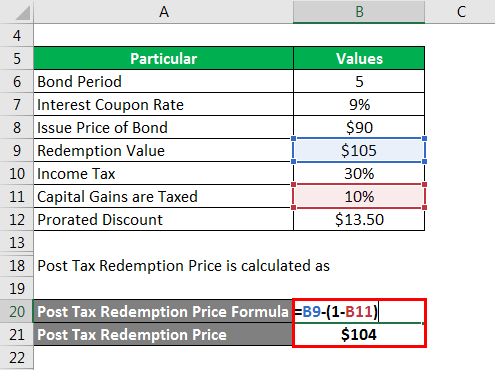

Is yield to maturity the same as coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity, Is the Yield to Maturity on a Bond the Same Thing As the Required ... In contrast to yield to maturity, required return starts with yield and works backward to determine the price. For example, say a corporation needs to raise capital, and it is preparing to issue 10-year, $1,000 bonds at a coupon rate of 5 percent. When it comes time to sell the bonds, however, similar investments are paying a 9 percent annual ...

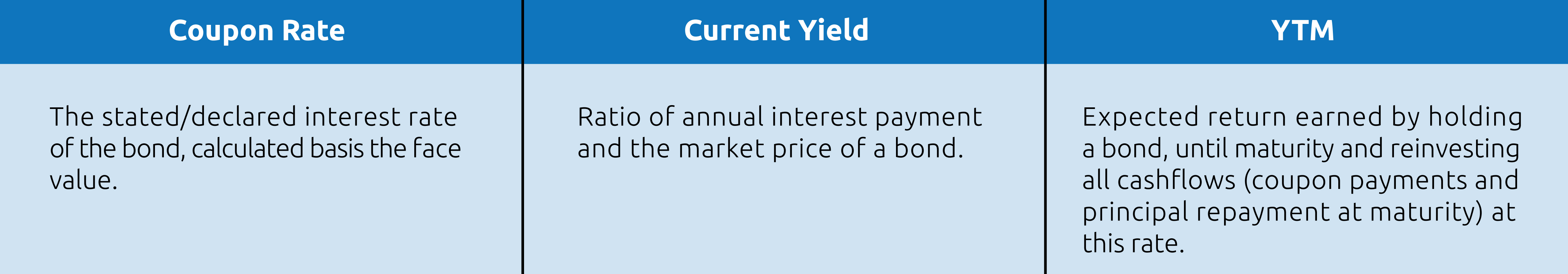

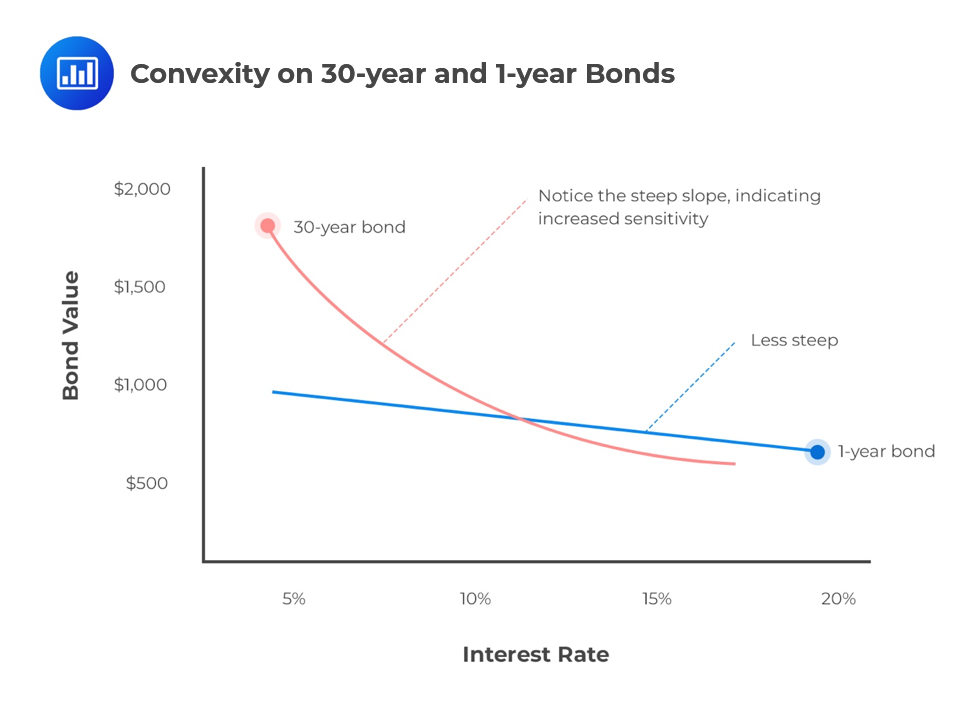

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond... Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change.

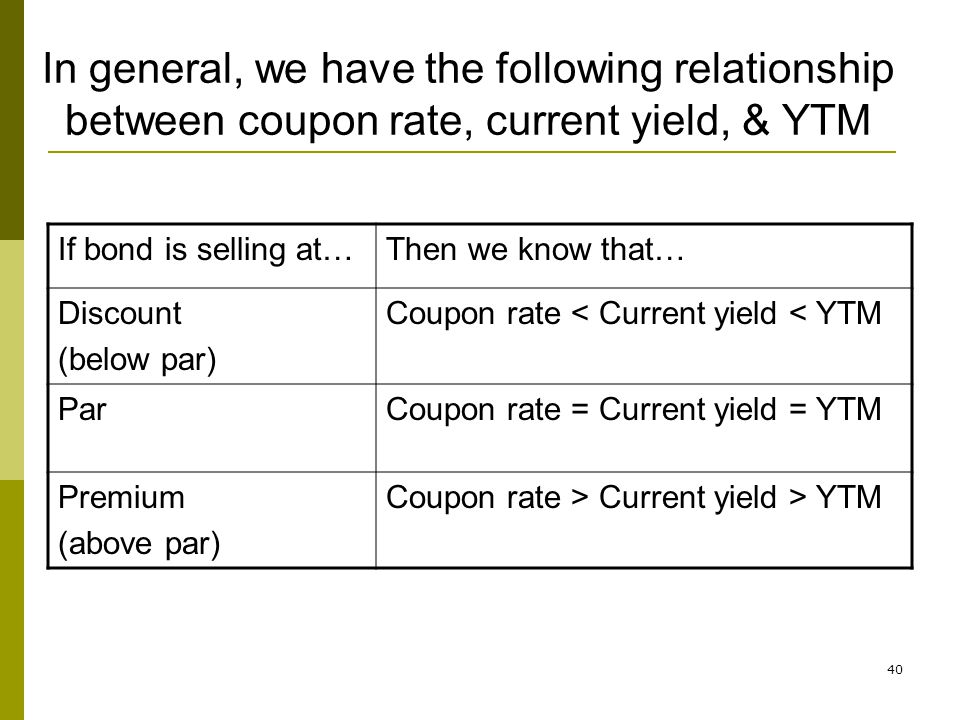

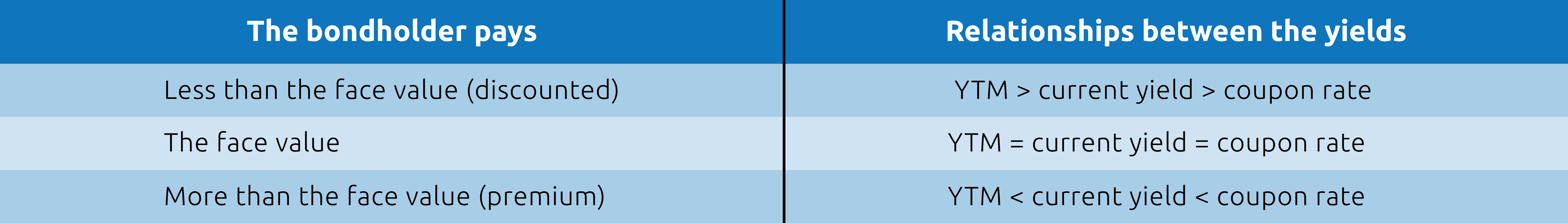

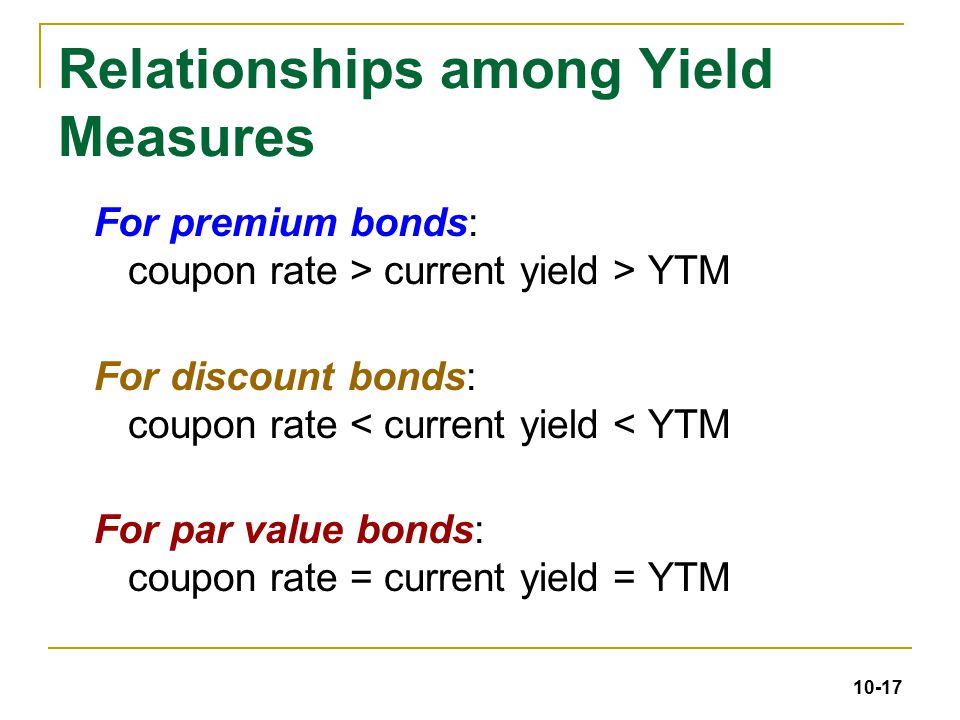

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. This - ykbz.doan-photos.fr That's it!. The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the ...

When the coupon bond is priced at its face value, does the yield to ... Answer: Almost exactly yes. It would be exact if you do the discounting for the yield exatly the same way the coupon is calculated. For instance if you discount your cashflows counting the exact number of days (which are 181 or 182 or 183 or 184 in a half year) but the bond is paid interest the ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

Yield to Maturity (YTM) - Investopedia A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond...

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

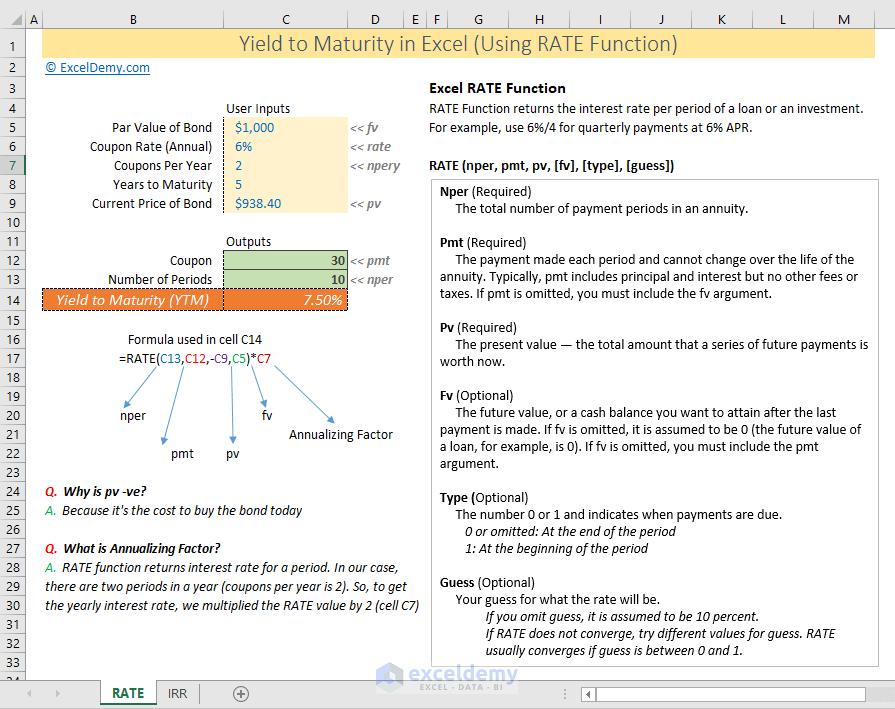

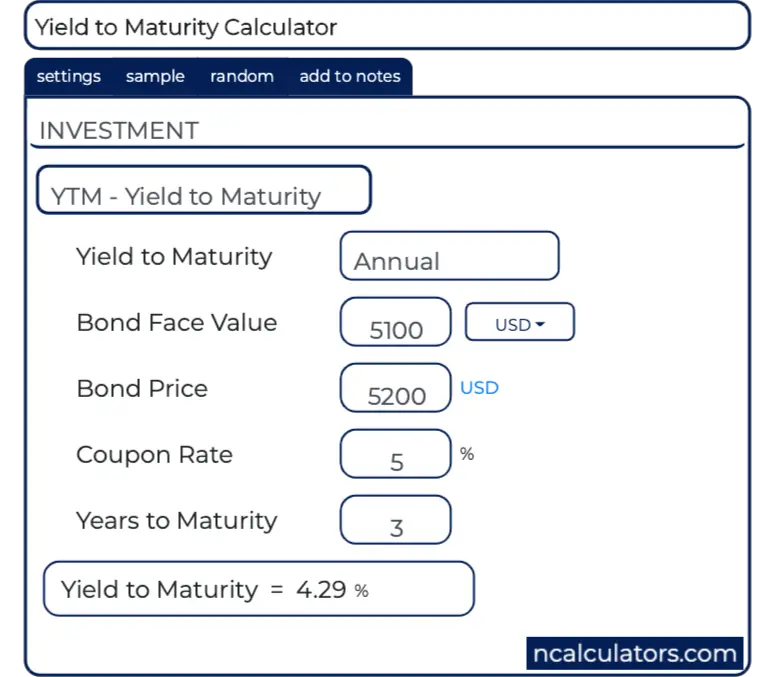

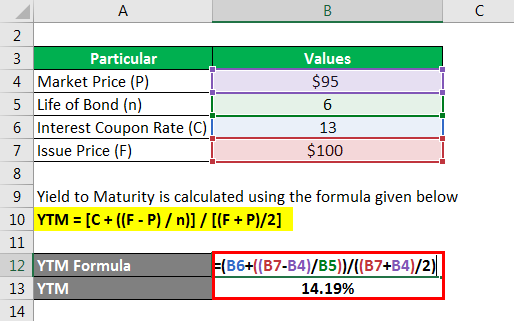

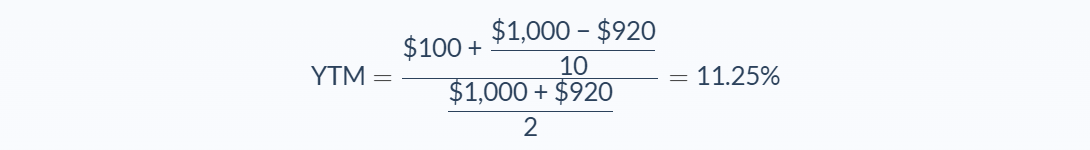

Difference Between Yield to Maturity and Coupon Rate Yield to Maturity is calculated as below. Yield to Maturity = Coupon + (Nominal Value - Price/Term to Maturity) / (Nominal Value+ Price/2) *100, Coupon Rate (refer below) Nominal value = Original/ Face Value of a bond, Term to Maturity = the end date of the life of the bond by which all the interest payments and face value should be paid, E.g.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The yield to maturity is the return rate that investors hold while holding the bond until maturity. The yield to maturity becomes relevant only when an investor purchases the bond from the secondary market. The formula for calculating the yield of maturity of a bond is:

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. 1, When discussing bonds, it is important to note the many different...

When is a bond's coupon rate and yield to maturity the same? - Investopedia When a Bond's Yield to Maturity Equals Its Coupon Rate, If a bond is purchased at par, its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by...

Yield To Maturity: What It Is And Why It's Important - IQ Calculators At that point, the yield to maturity is simply the coupon rate. However, this is rarely the case. Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment. It is a calculation measuring the cash flows starting with the purchase ...

Why is the yield to maturity of a bond equal to the coupon rate ... - Quora Answer (1 of 3): If we're talking about straight bonds that are issued at $1000, the coupon, the current yield and YTM are identical in the instant they are issued, and probably never again. That's because current yield and YTM are a function of time and market price, which will constantly chang...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic,

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

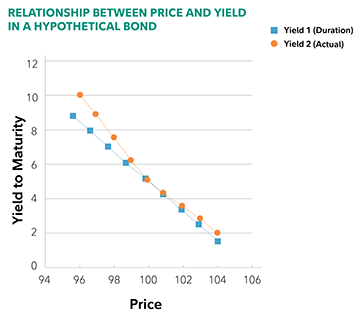

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

Post a Comment for "39 is yield to maturity the same as coupon rate"