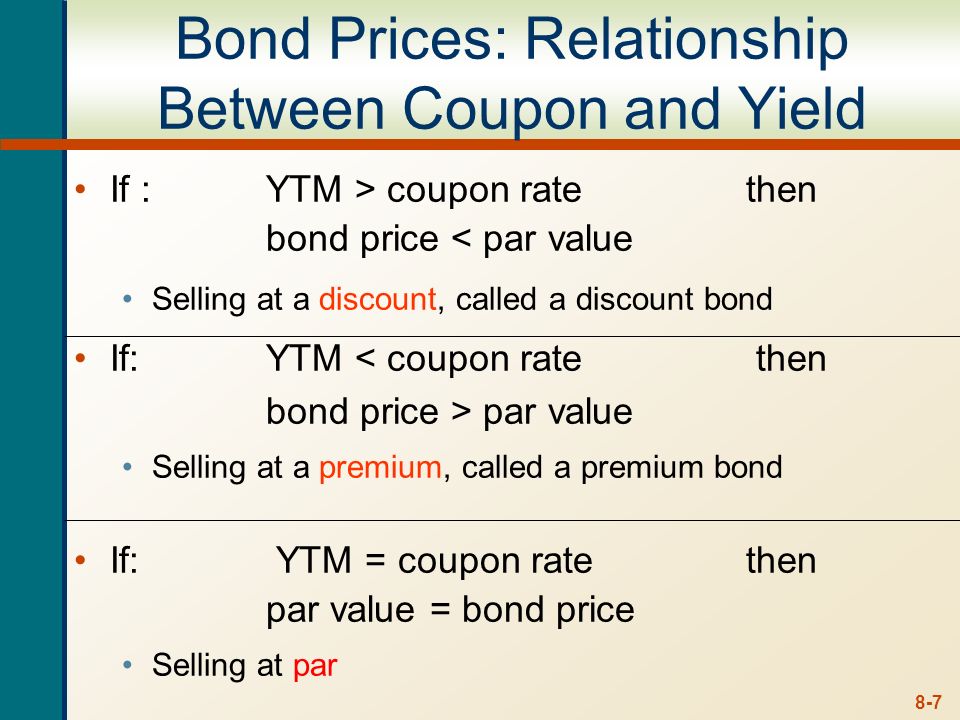

39 relationship between coupon rate and ytm

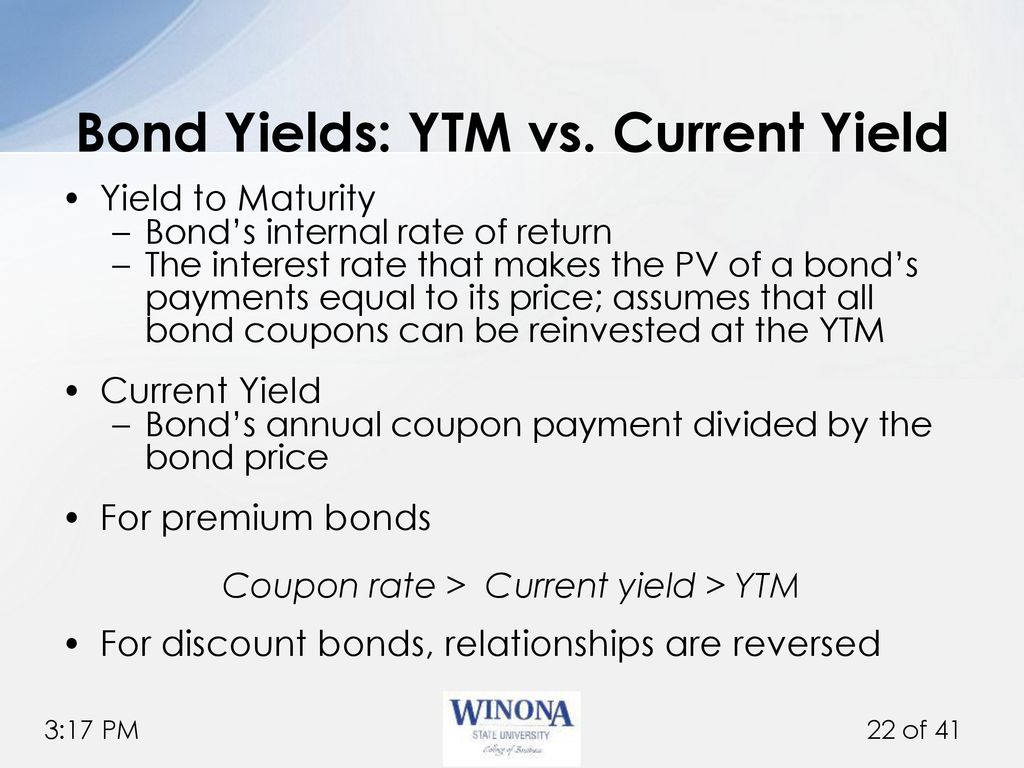

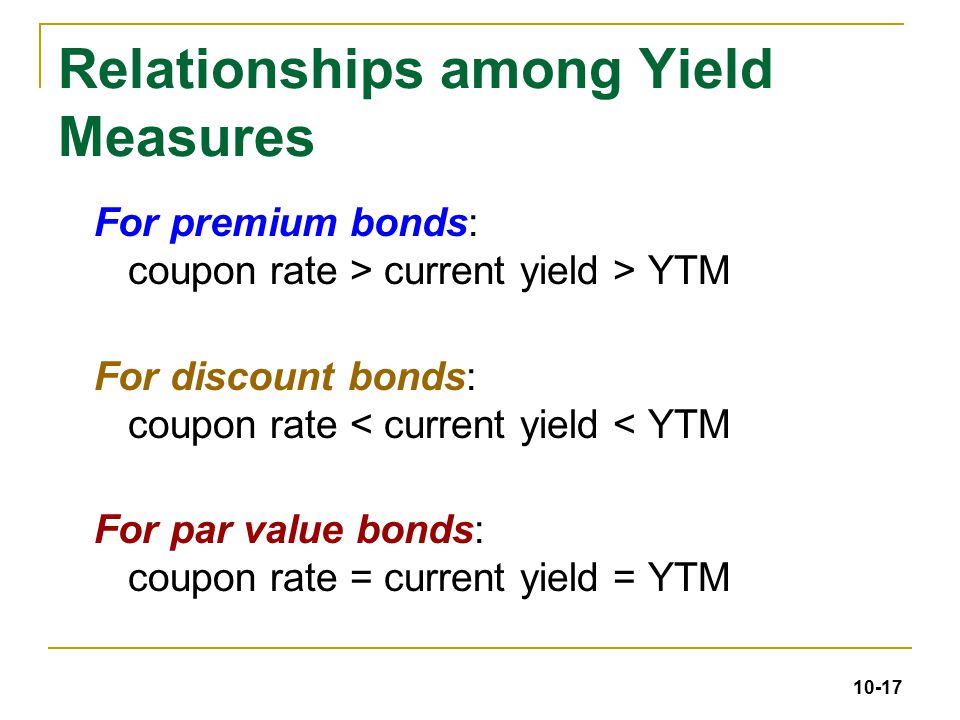

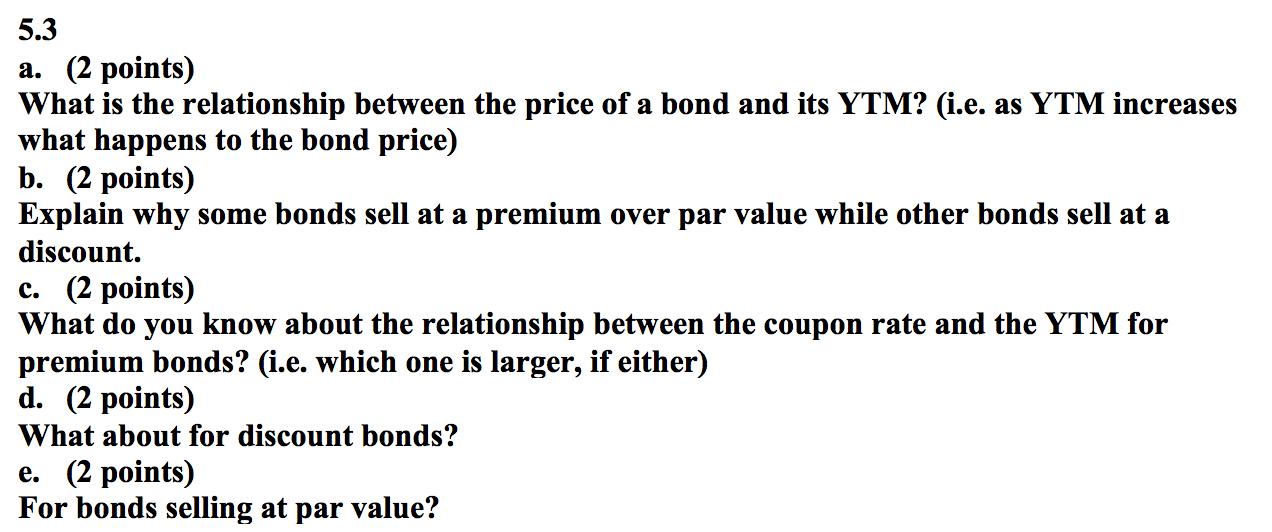

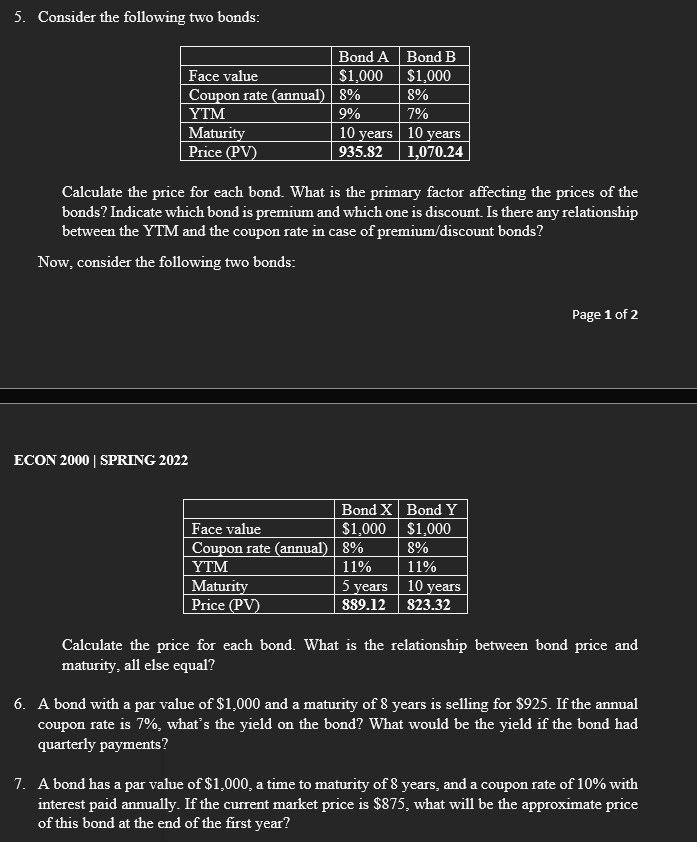

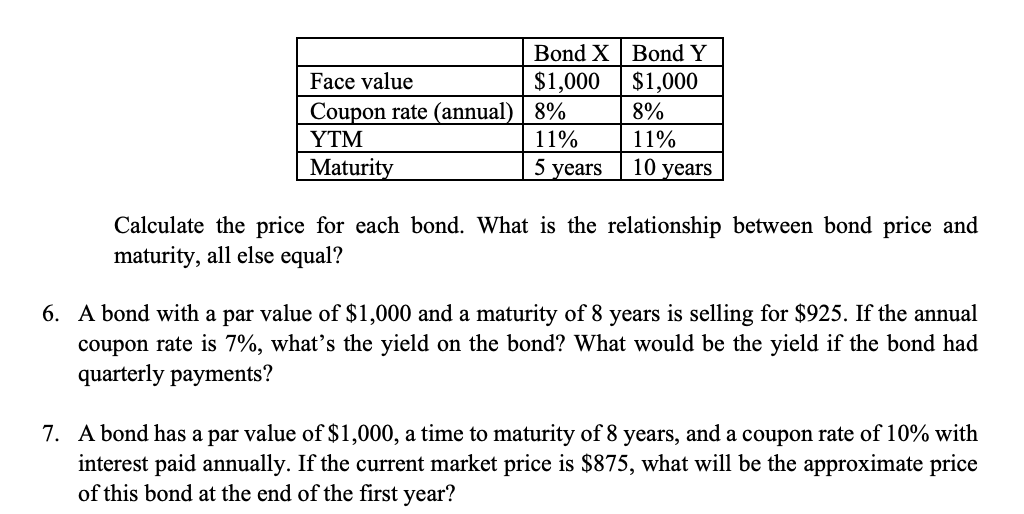

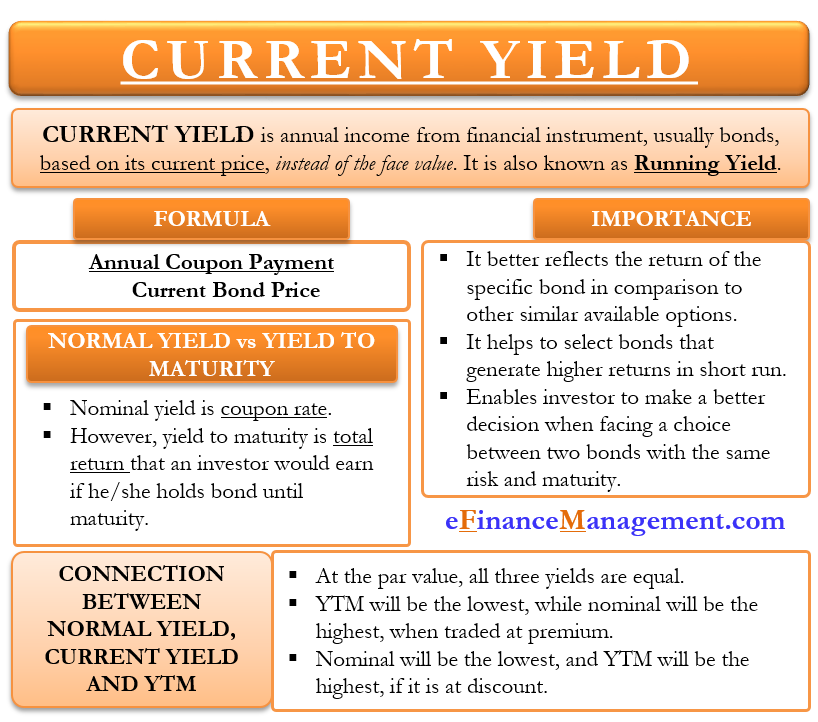

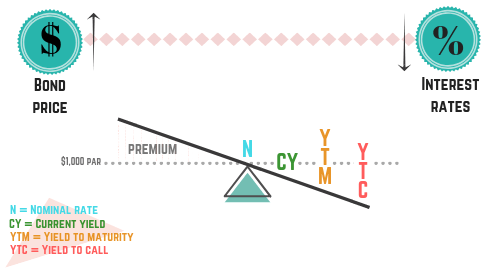

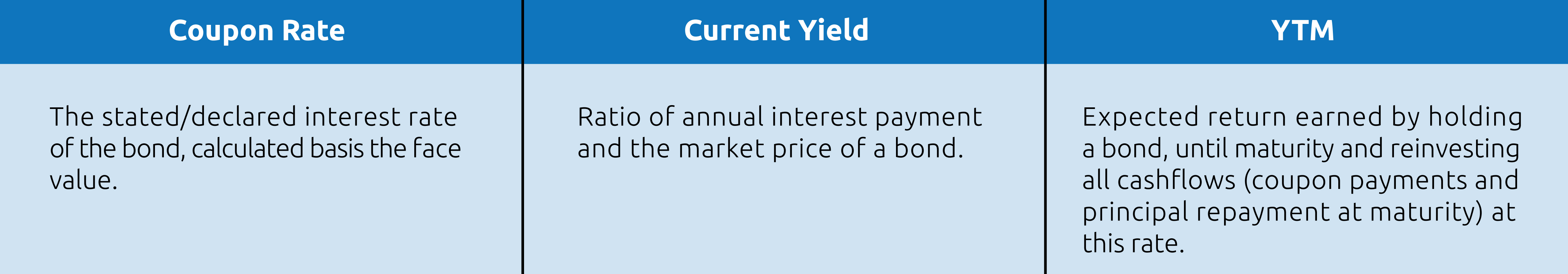

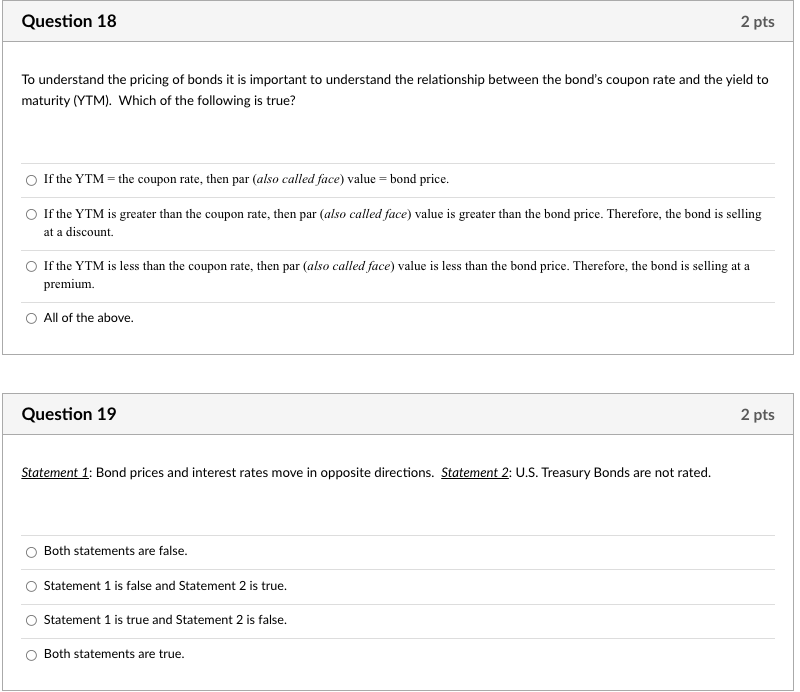

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2.

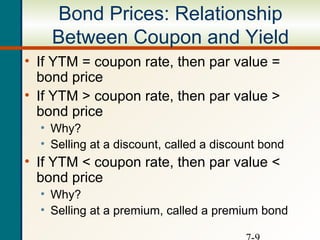

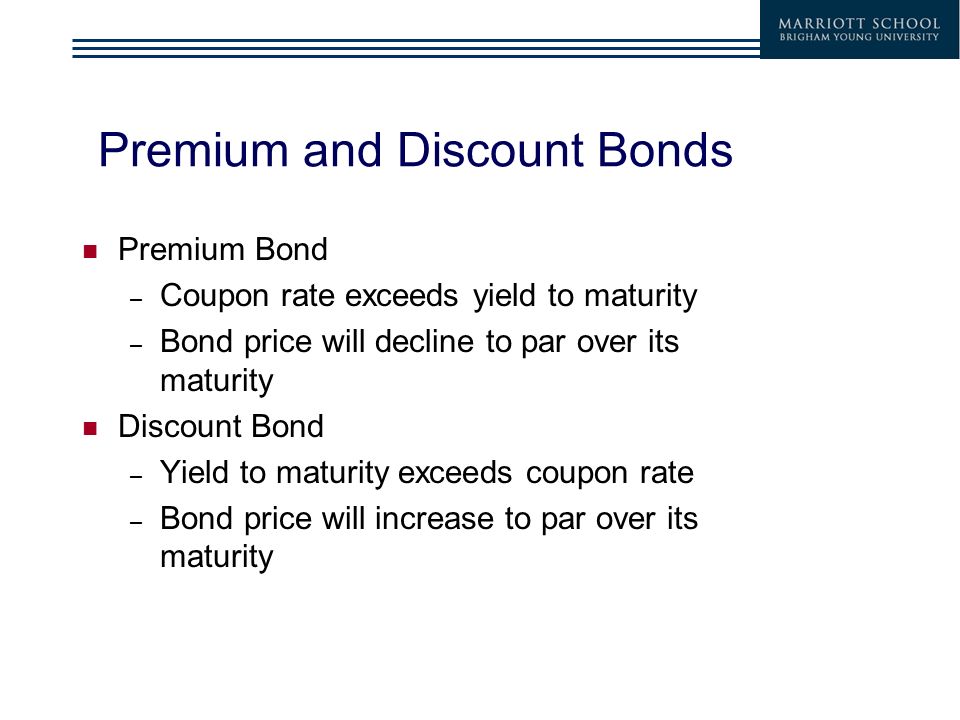

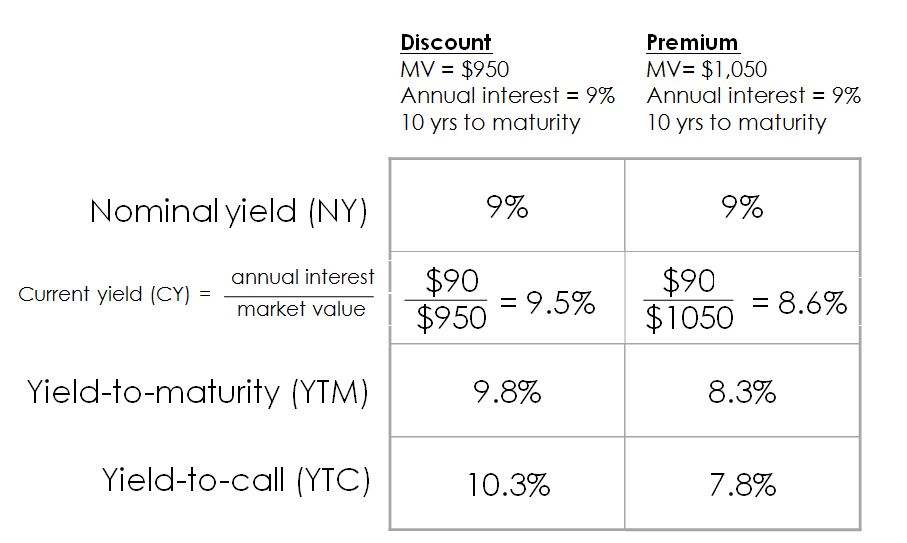

Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer.

Relationship between coupon rate and ytm

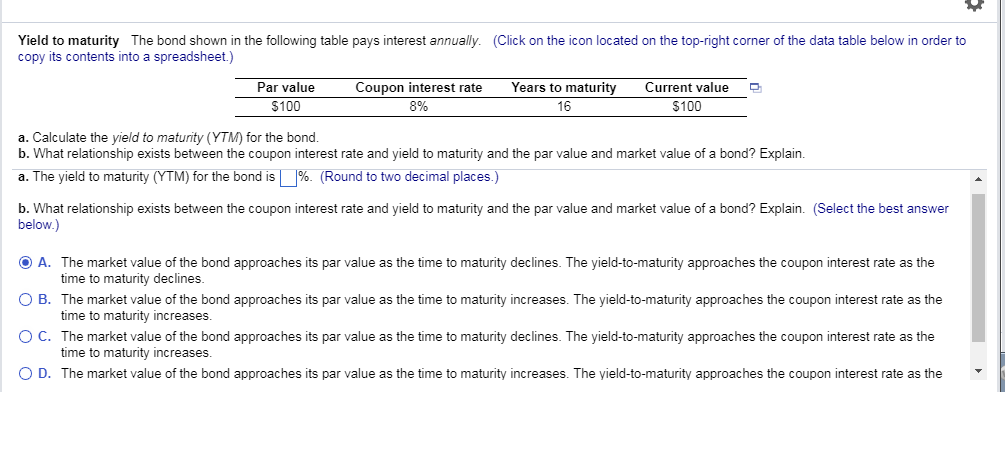

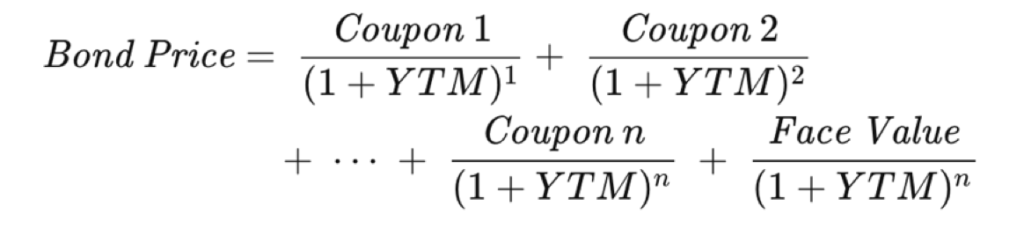

financetrainingcourse.com › education › 2012How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond). Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Solved The bond shown in the following table pays | Chegg.com Par value $1,000 Coupon interest rate 9% Years to maturity 8 Current value $820 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is%. (Round to two decimal ...

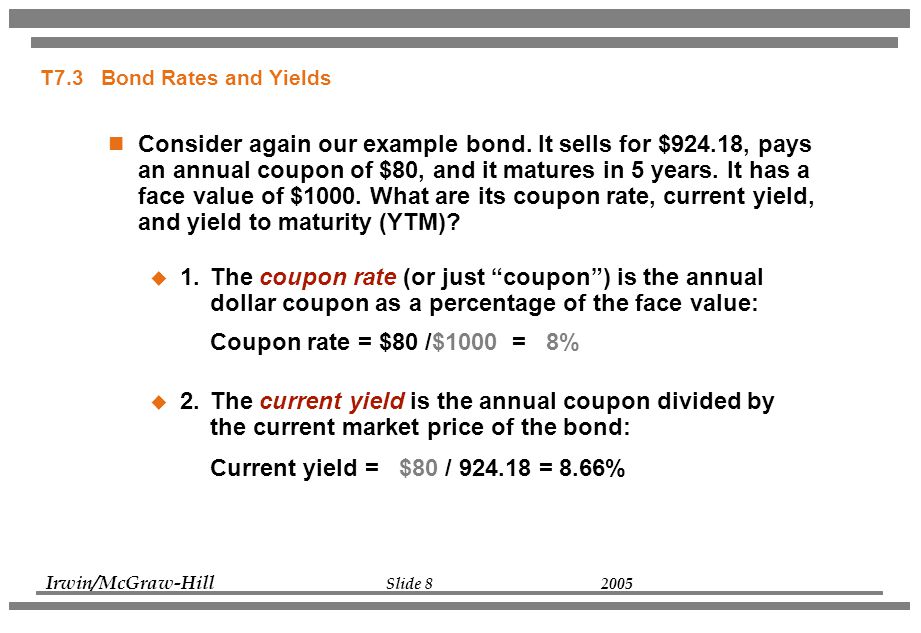

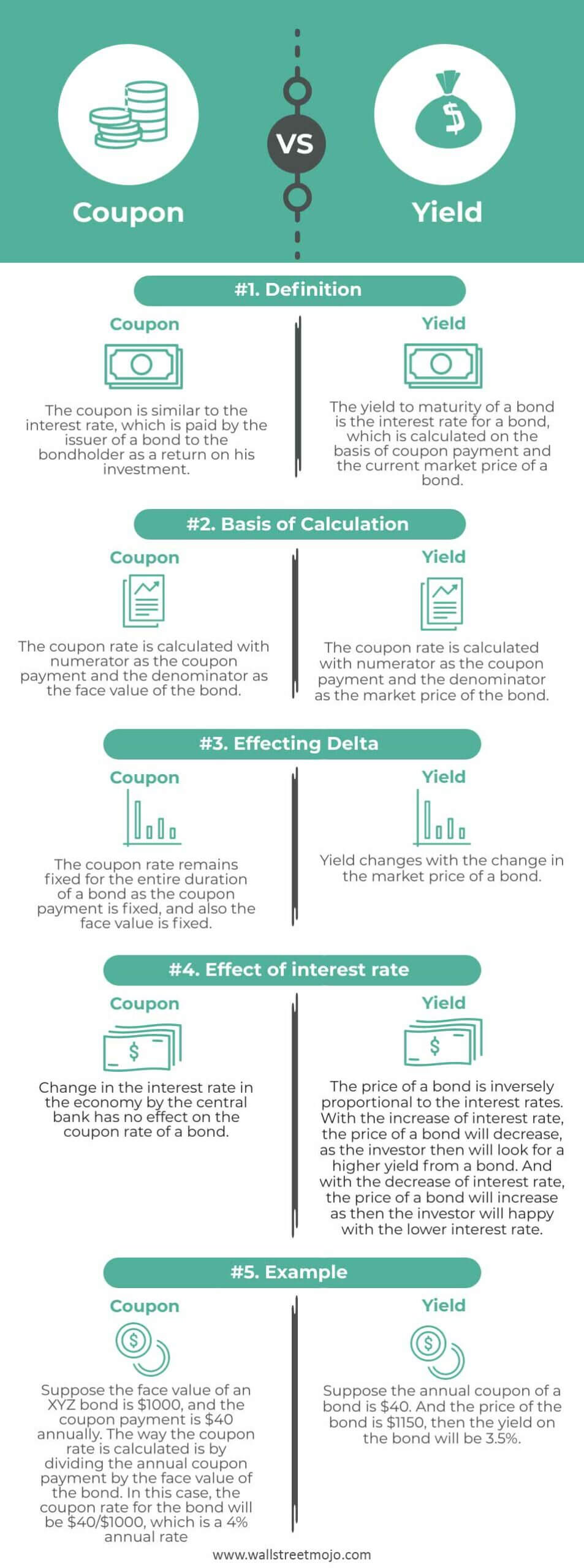

Relationship between coupon rate and ytm. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... The Relationship Between a Bond's Price & Yield to Maturity However, if you only pay $900 for the bond, your yield to maturity will be greater because, in addition to the 6 percent interest, you'll earn a capital gain of $100. If you paid more than $1,000 for the bond, your yield to maturity would be less than 6 percent, as you would get back less than you paid at maturity. 00:00 00:00. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

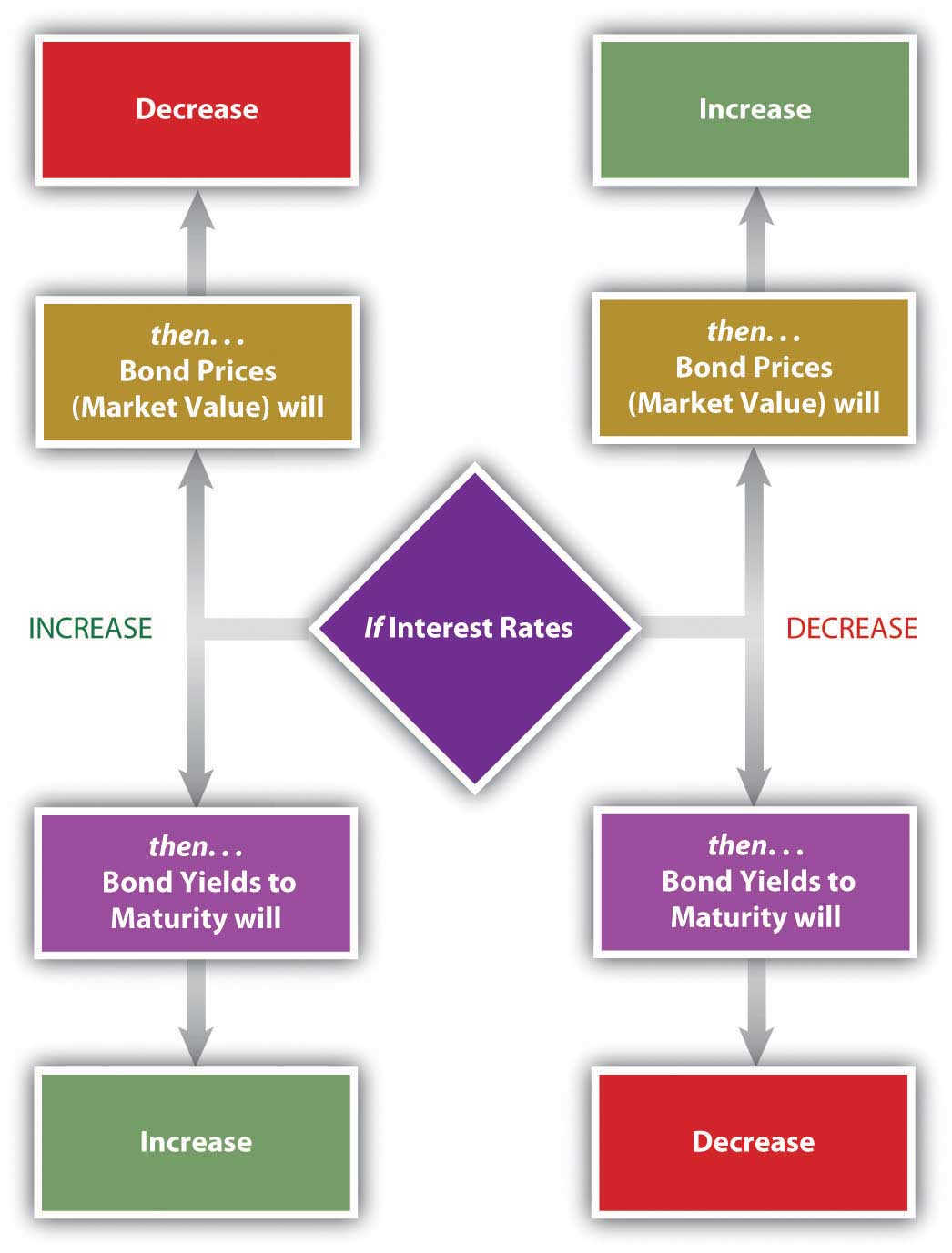

› ask › answersCurrent Yield vs. Yield to Maturity - Investopedia When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond sells for less than par, which is known... YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India - The Fixed Income Scenario 1: interest rates rose to 8.0% Increased interest rate will drive the coupon rate (8.0%) on the newly issued bonds to be higher than the coupon rate on the existing bonds (7.5%). This will lead to an increase in the YTM of the existing bond, which now equates to YTM on the newly issued bond, being 8.0%; while the market price of the ... What relationship between a bond's coupon rate and a bond's yield would ... If the bond yield is less than the bond's coupon rate, then the bond will trade at a premium. Likewise, if the bond yield is more than the bond's coupon rate, then the bond will trade at a discount. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

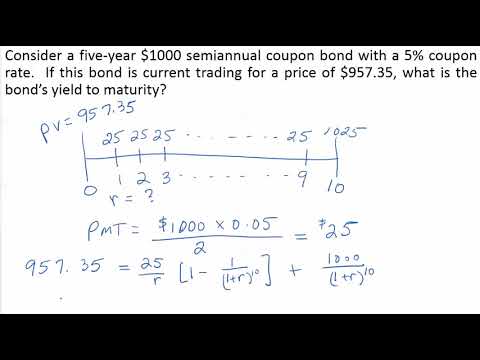

› yield-to-maturity-ytmYield to Maturity (YTM) - Wall Street Prep Annual Coupon Rate (%): 6.0%; Number of Years to Maturity: 10 Years; Price of Bond (PV): $1,050; We’ll also assume that the bond issues semi-annual coupon payments. Given those inputs, the next step is to calculate the semi-annual coupon rate, which we can calculate by dividing the annual coupon rate by two. Semi-Annual Coupon Rate (%) = 6.0% ... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering... Solved What is the relationship between coupon rates, YTM ... - Chegg See the answer What is the relationship between coupon rates, YTM, and bond value? Expert Answer At face value, the coupon rate and yield equal each other. If you sell your $1,000bond at a $100 premium, the bond's yield is now equal to $40 / $1,100, or 3.63%. Thus, yield and … View the full answer Previous question Next question Solved Ali is evaluating issuing bonds for his company and | Chegg.com Ali finally decides to issue the bond for his company. A 15-year, 6% coupon bond pays interest annually. The bond has a face value of $1,000. 2- What is the change in the price of this bond if the market yield to maturity rises to 6.5% from the current rate of 6.25%? Ali the asks his colleagues about the return of the bond and makes the comment ...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Relationship Between Yield To Maturity and Coupon Rate - LiquiSearch Famous quotes containing the words relationship, yield, maturity and/or rate: " We must introduce a new balance in the relationship between the individual and the government—a balance that favors greater individual freedom and self-reliance. —Gerald R. Ford (b. 1913) " Such were garrulous and noisy eras, which no longer yield any sound, but the Grecian or silent and melodious era is ...

The Relation of Interest Rate & Yield to Maturity - Zacks Yield to Maturity Defined. A bond's yield to maturity accounts for the price that is paid for a bond as well as the coupons and final principal payment a bondholder receives when the bond ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%.

Relationship between Current Yield Yield to Maturity and Coupon Rate ... when a bond sells at par, its current yield = coupon rate = yield to maturity when it sells at a discount, its yield to maturity > current yield > coupon rate when it sells at a premium, its coupon rate > current yield > yield to maturity conventions in calculation of accrued interest and price to be paid if a trade takes place on the date when …

Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Solved what relationship exists between the coupon interest - Chegg Current value $480 Years to maturity Par value $500 Coupon interest rate 13% a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. b.

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

The Relationship Between Bond Prices and Interest Rates - AOL The yield will match the coupon rate when a bond is issued and sold at par value. However, if an investor pays less than the par value, their return would be more significant since the coupon ...

Solved The bond shown in the following table pays | Chegg.com Par value $1,000 Coupon interest rate 9% Years to maturity 8 Current value $820 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is%. (Round to two decimal ...

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

financetrainingcourse.com › education › 2012How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond).

![Bond Yield: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/11180917/Bond-Yield-Metrics-e1644621656277-960x490.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "39 relationship between coupon rate and ytm"