44 risk of zero coupon bonds

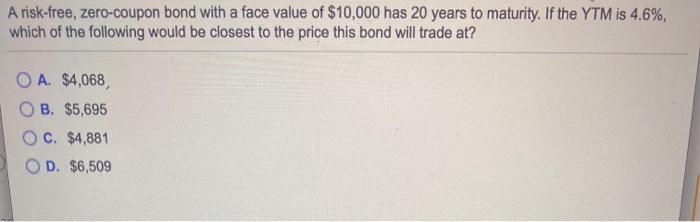

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Investor's Guide to Zero-Coupon Municipal Bonds Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value.

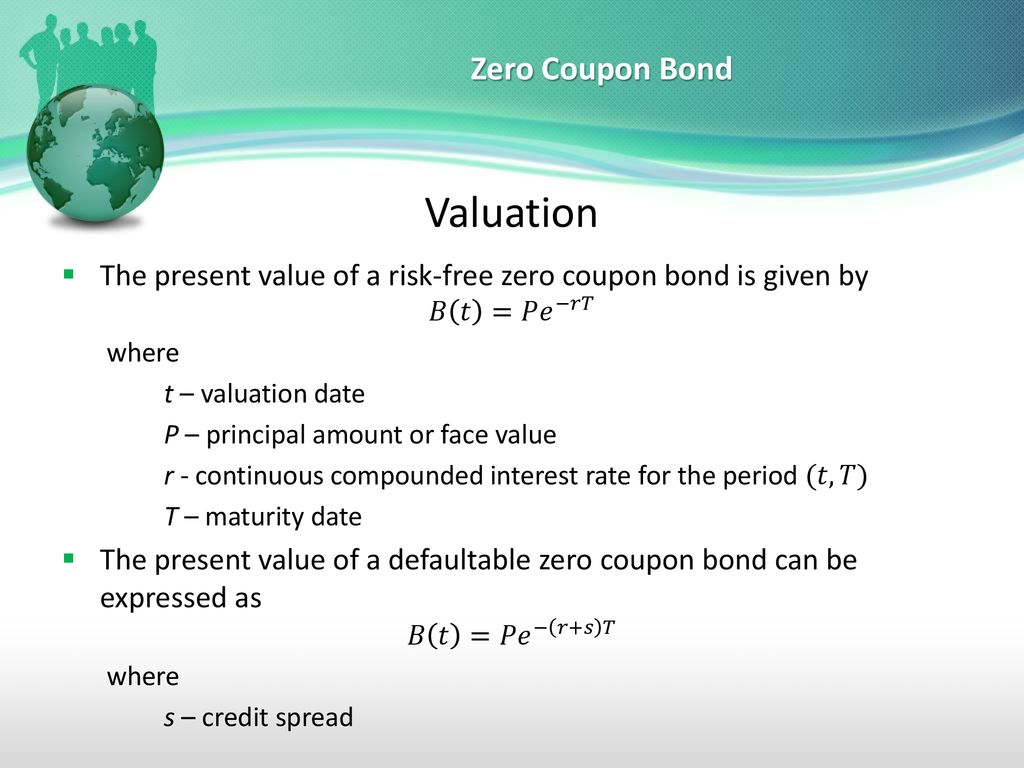

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Risk of zero coupon bonds

Reserve Bank of India - Master Circulars Jul 01, 2015 · Credit risk can be associated with almost any transaction or instrument such as swaps, repos, CDs, foreign exchange transactions, etc. Specific types of credit risk include sovereign risk, country risk, legal or force majeure risk, marginal risk and settlement risk. Debentures: Bonds issued by a company bearing a fixed rate of interest usually ... Pros and Cons of Zero-Coupon Bonds | Kiplinger With retirement years away for you and today's low interest rates, we'd advise against buying zeros. These bonds don't make regular interest payments. Instead, they're sold at a big discount to ... What Is a Bond Coupon? - The Balance Zero-coupon bonds pay no cash interest. They're issued at a discount to their maturity value instead. The discount provides a cited rate of return by maturity when the bonds are supposed to be redeemed for their full face value. Zero-coupon bonds tend to be more sensitive to interest rate risk. You have to pay income tax on the imputed interest ...

Risk of zero coupon bonds. How to Invest in Zero-Coupon Bonds - US News & World Report "Zero-coupon bonds perform worse than traditional coupon paying bonds in a rising interest rate environment due to their longer duration," says John Linton, of Elbert Capital Management in Denver.... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Should I Invest in Zero Coupon Bonds? | The Motley Fool The downsides of zero coupon bonds For some investors, being more sensitive to rate changes is a negative rather than a positive. If you don't intend to hold your bond to maturity, you have to stay... Learn About Zero Coupon Bond | Chegg.com A zero-coupon bond is a debt security that sells without an expressed coupon rate. These bonds are sold at deep discounts and do not pay monthly interest as typical bonds do.This way, the bond issuer does not need to worry about interest rate changes, and the investors receive a lump sum amount at maturity rather than regular coupon interest.. Bond issuers give out bonds to finance their long ...

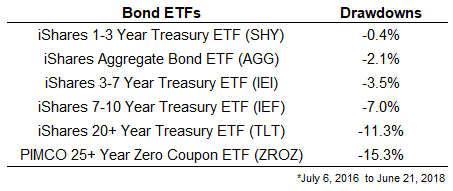

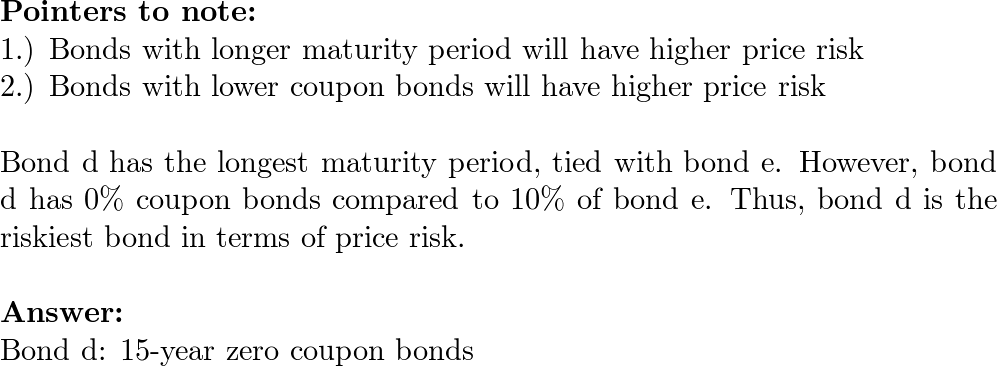

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N'). Disadvantages of Zero-Coupon Bonds The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life of the Bond. What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia Risks associated with Zero-Coupon Bonds As there is no coupon rate, ZCBs are safer as compared to other fixed-income instruments, which are sensitive to changes in interest rates. But ZCBs do possess risk subjected to changes in interest rates if sold before maturity.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · These coupon payments are theoretically to be reinvested when they are paid, but because interest rates can change over the life of a bond, there is reinvestment risk. Since a zero-coupon bond ... Zero-Coupon Bond: What are Zero-Coupon Bonds? - Wall Street Prep One drawback to zero-coupon bonds is their pricing sensitivity based on the prevailing market interest rate conditions. Bond prices and interest rates have an "inverse" relationship with one another: Declining Interest Rates Higher Bond Prices Rising Interest Rates Lower Bond Prices Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the value of the dollars the bond will eventually pay. In the United States, you need to impute the interest for some zero coupon bonds to pay taxes in the current year (possibly also for state or local taxes).

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly...

Mapping Zero-coupon Bonds to Risk Factors - Finance Train The first coupon is sensitive to the 6-month interest rate, the next coupon is sensitive to the one-year interest rate, and the last (10th) payment will be sensitive to the 5-year zero-coupon interest rate. For the purpose of mapping each cash flow, the risk manager will need to identify a set of zero-coupon bonds at different maturities.

Zero-Coupon Bond - The Investors Book Company's Survival: Since the maturity period of a zero-coupon bond is quite lengthy; it is challenging for the investor to trust that a company would survive until the maturity date. Interest Rate Risk : If the interest rate of the bond falls, its issuer may redeem it through call provision before maturity and at a lower price.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured.

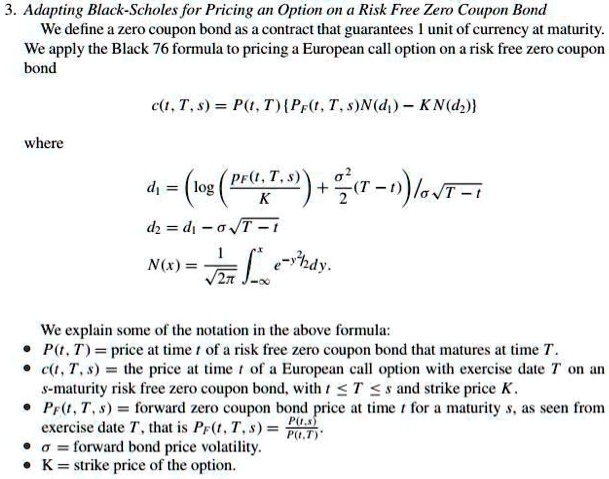

Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk As a first step, set the expected payoff equal to 0 where prob_D = probability of default, cur_Px = current price, mat_Px = maturity payment, and R = recovery. Therefore prob_D * (recovery - cur_Px) + (1 - prob_D) * (mat_Px - cur_Px) = 0 results in prob_D = (cur_Px - mat_Px) / (R - mat_Px)

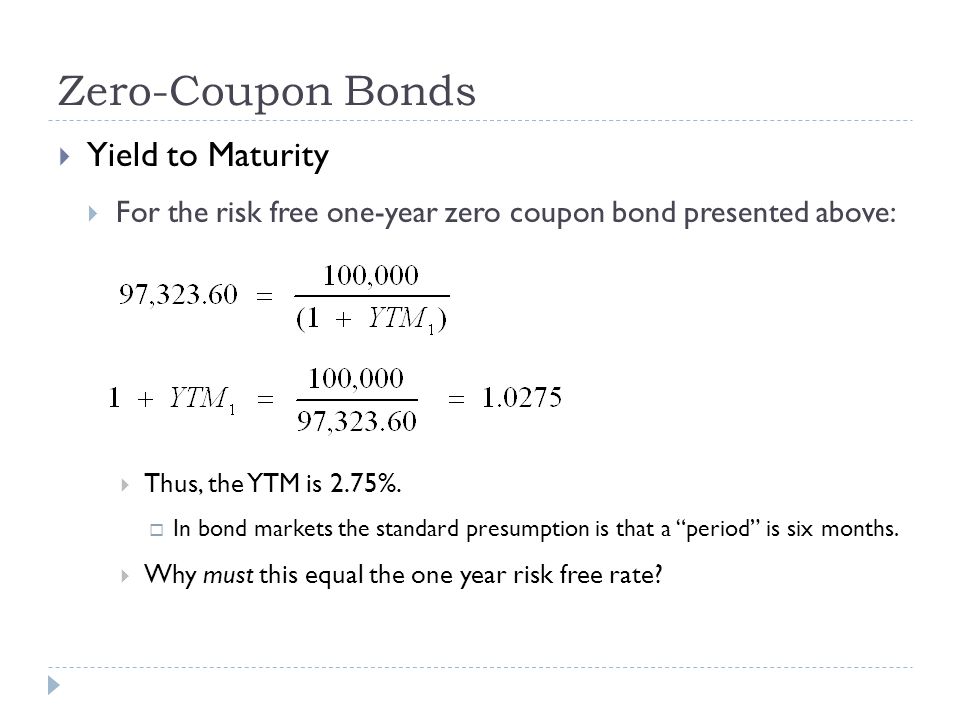

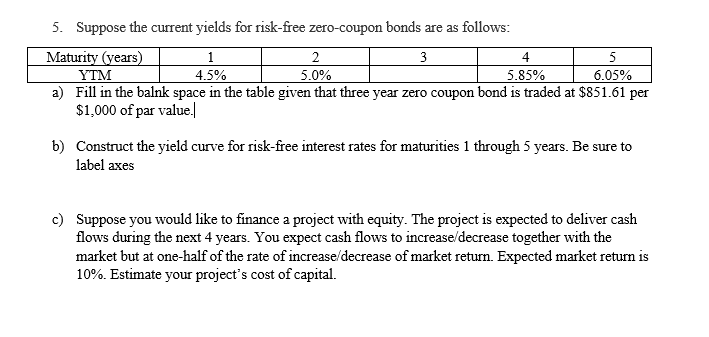

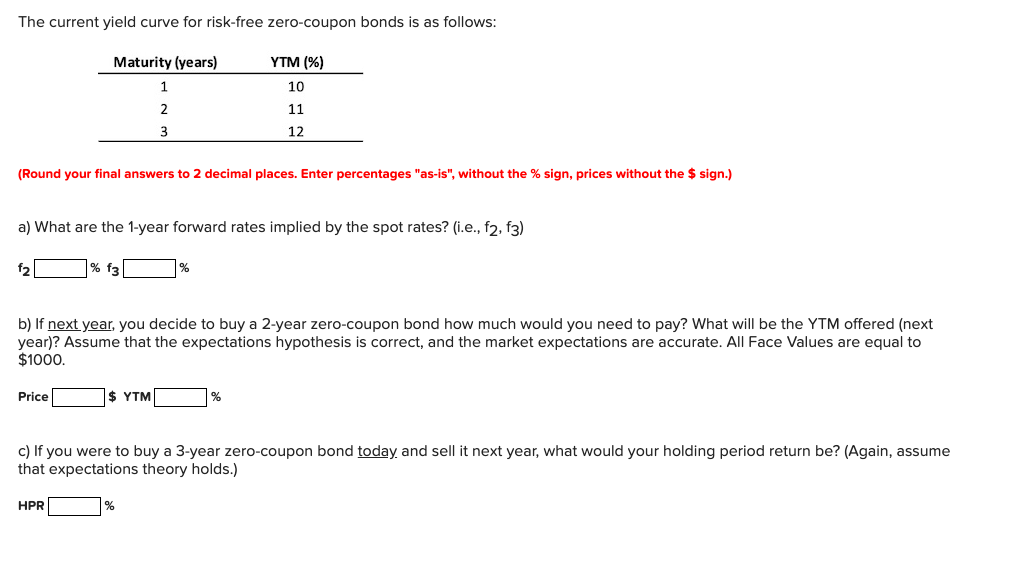

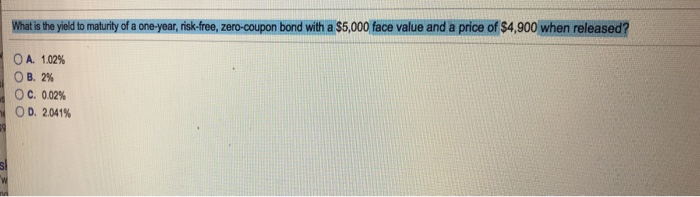

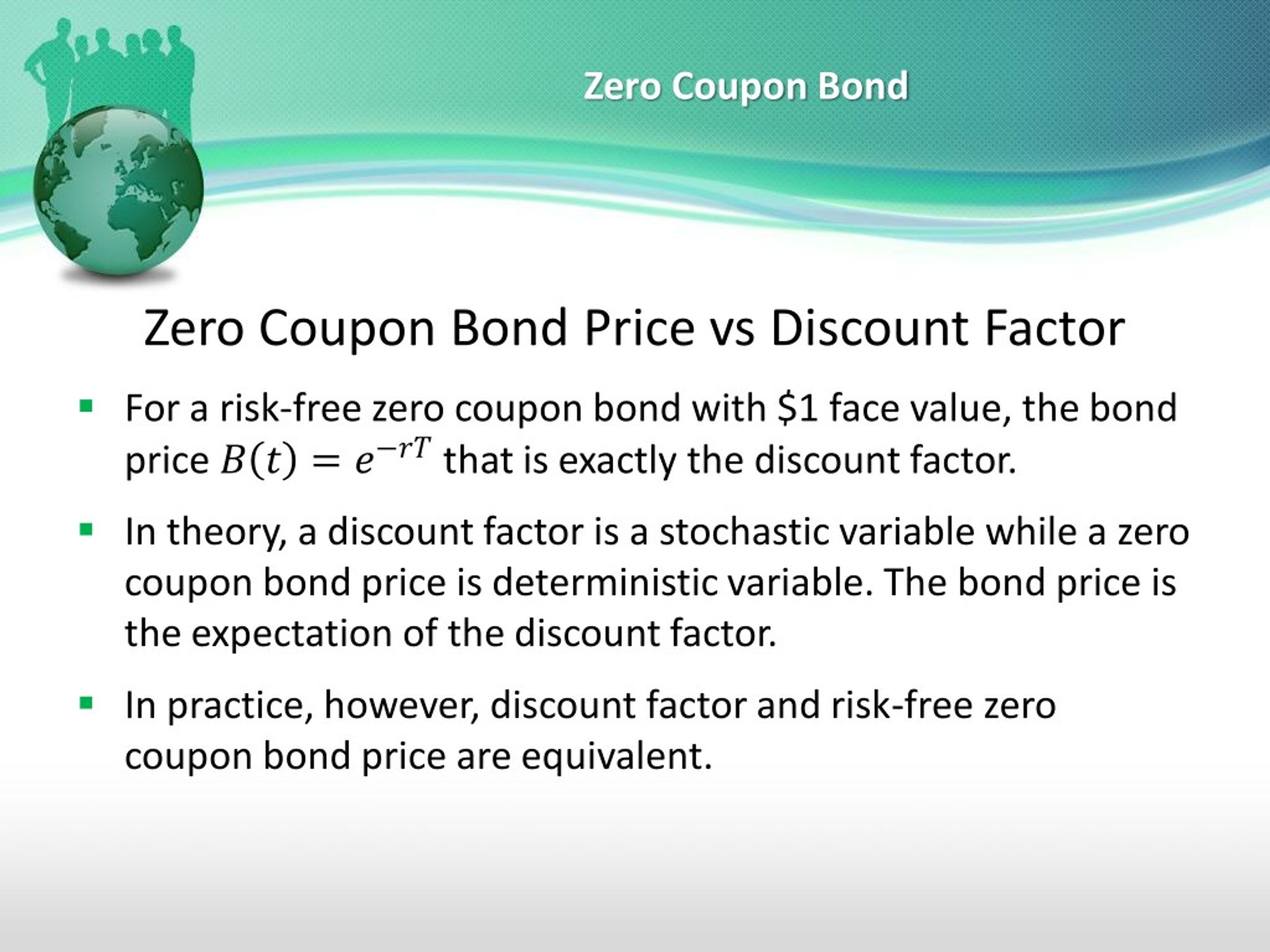

Use of Government Bonds in calculating risk-free rates - Refinitiv This article explains what Net Present Values, Face Values, Maturities, Coupons, Yield to Maturity, compound frequency, Coupon rates and risk-free rates are, how to compute them, and how they are used to calculate excess returns using only Zero-Coupon Bonds; other types of bonds are discussed for completeness, but they will only be investigated as such in further articles to come. It is aimed ...

How to Calculate a Zero Coupon Bond Price | Double Entry ... The discount rate to use will depend on the risk associated with the cash flows from the zero coupon bond. Suppose the discount rate was 7%, the face value of the bond of 1,000 is received in 3 years time at the maturity date, and the present value is calculated using the zero coupon bond formula which is the same as the present value of a lump sum formula .

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As a result, zero-coupon bond prices are more volatile — subject to greater swings when interest rates change. You have to pay taxes on income you don't get Even though you're not actually getting...

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Another problem with zero coupon bonds is that they have a higher default risk than traditional bonds. The reason behind this is that companies do not have to make regular interest payments to the investors. They just keep all of the money and do with it as they please.

What are zero-coupon bonds? - moneycontrol.com Sep 07, 2022 · Zero coupon bonds are issued at a discount to the face value of the bond. They do not pay interest during the tenure of the security. The investor of the zero coupon bond receives the face value ...

Why do zero coupon bonds have higher interest rate risk than bonds that ... Answer (1 of 5): They say timing is everything! That's certainly true in finance. The answer hinges on the concept of duration. Assume that credit risk can be ignored for a borrower who wants to borrow for 20 years. You can choose between a standard coupon-paying bond that pays interest in equal ...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically. This is because the bond does not pay interest periodically. Hence, investors do not receive any cash flow which they have to reinvest periodically.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

What Is a Bond Coupon? - The Balance Zero-coupon bonds pay no cash interest. They're issued at a discount to their maturity value instead. The discount provides a cited rate of return by maturity when the bonds are supposed to be redeemed for their full face value. Zero-coupon bonds tend to be more sensitive to interest rate risk. You have to pay income tax on the imputed interest ...

Pros and Cons of Zero-Coupon Bonds | Kiplinger With retirement years away for you and today's low interest rates, we'd advise against buying zeros. These bonds don't make regular interest payments. Instead, they're sold at a big discount to ...

Reserve Bank of India - Master Circulars Jul 01, 2015 · Credit risk can be associated with almost any transaction or instrument such as swaps, repos, CDs, foreign exchange transactions, etc. Specific types of credit risk include sovereign risk, country risk, legal or force majeure risk, marginal risk and settlement risk. Debentures: Bonds issued by a company bearing a fixed rate of interest usually ...

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "44 risk of zero coupon bonds"